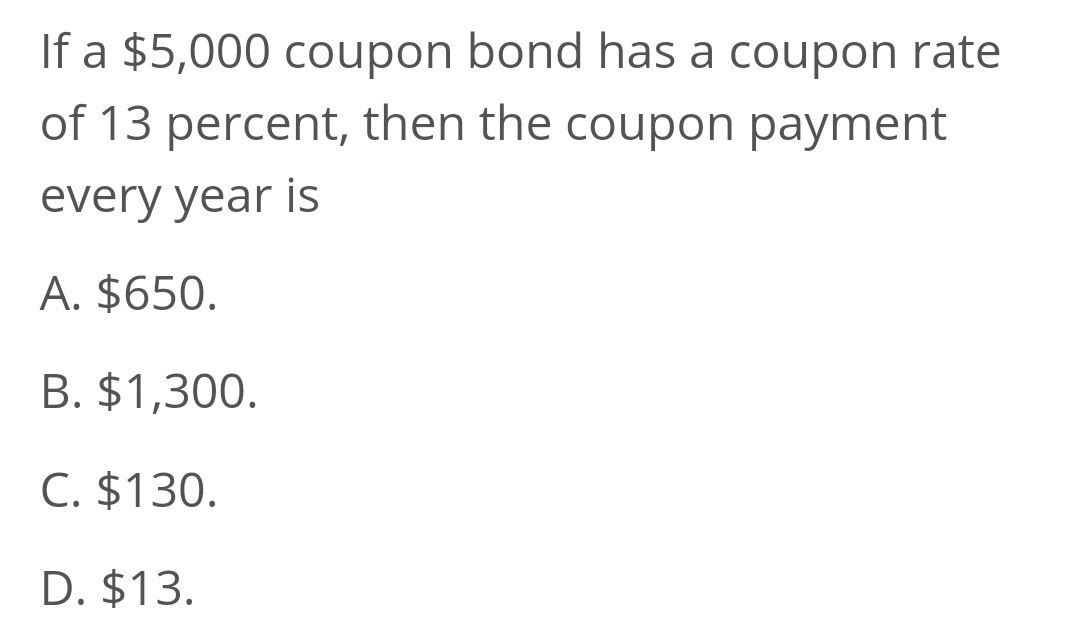

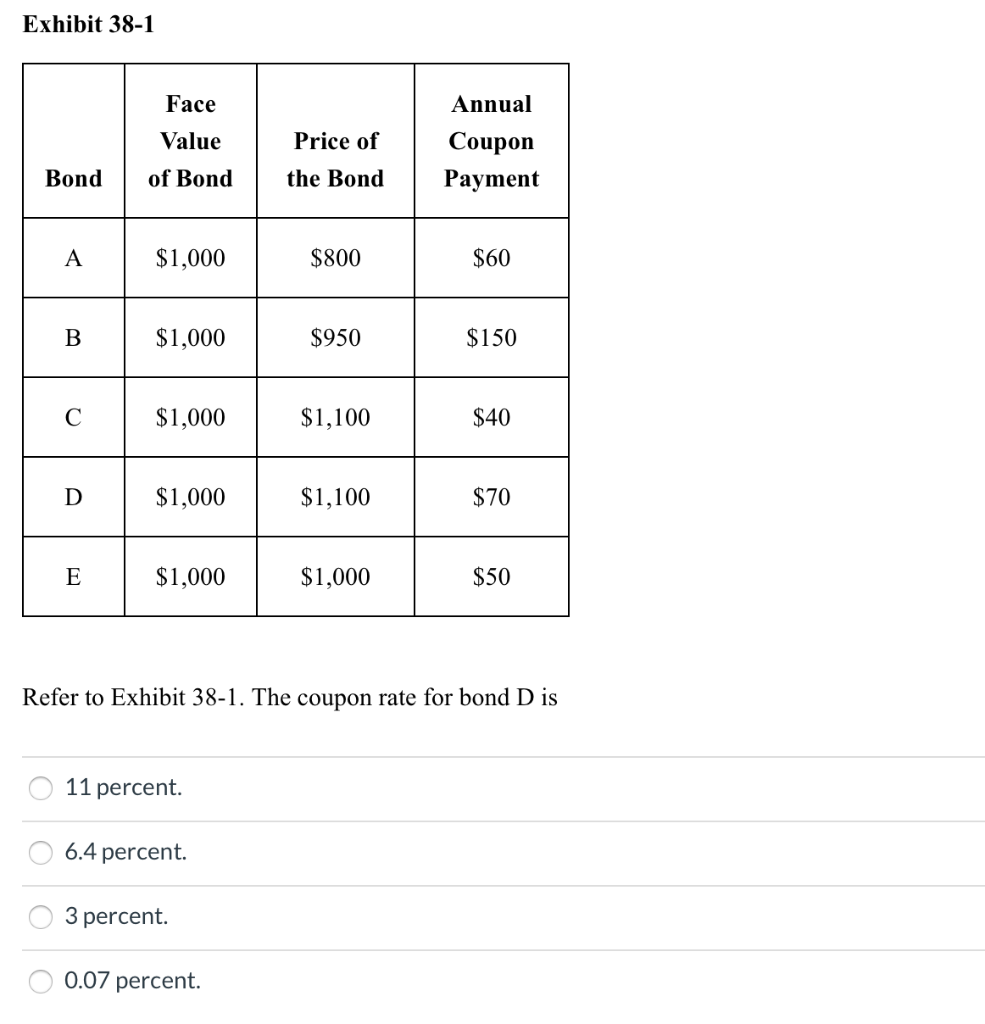

44 what is a coupon payment on a bond

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays …

What is a coupon payment on a bond

Coupon Payment Calculator 08/07/2022 · The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called.The payment schedule can be quarterly, semiannually or annually, depending on the agreed time.. When a bond is first issued, the bond's price is its face value. The bond issuer pays a bondholder a percentage of the face value every … Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ...

What is a coupon payment on a bond. Treasury Coupon Issues | U.S. Department of the Treasury Progress Towards an Evaluation of Economic Impact Payment Receipt by Race and Ethnicity . October 4, 2022. Treasury Department Announces Inaugural Members of Formal Advisory Committee on Racial Equity. View all Featured Stories. Press Releases. October 24, 2022. Treasury Sanctions Nicaragua Directorate of Mines and Government Official Responsible for … Bond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ... Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ... Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are ... What Is a Bond Coupon? - The Balance 04/03/2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) 02/08/2020 · To calculate a coupon payment, multiply the value of the bond by the coupon rate to find out the total annual payment. Alternatively, if your broker told you what the bond yield is, you can multiply this figure by the amount you paid for the bond to work out the annual payment. To calculate the actual coupon payment, divide the annual payment ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues. Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data. Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Coupon Payment Calculator 08/07/2022 · The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called.The payment schedule can be quarterly, semiannually or annually, depending on the agreed time.. When a bond is first issued, the bond's price is its face value. The bond issuer pays a bondholder a percentage of the face value every …

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 what is a coupon payment on a bond"