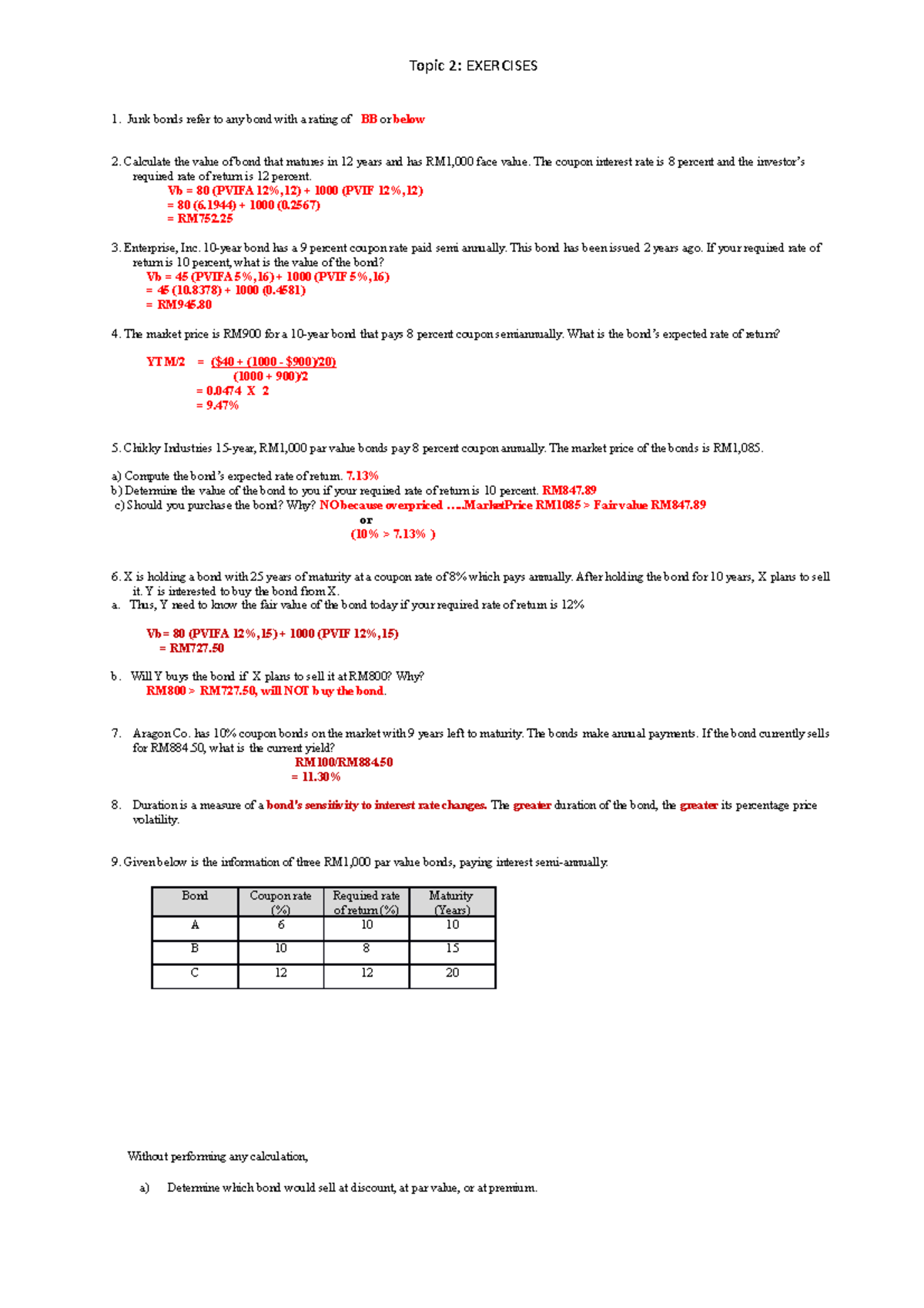

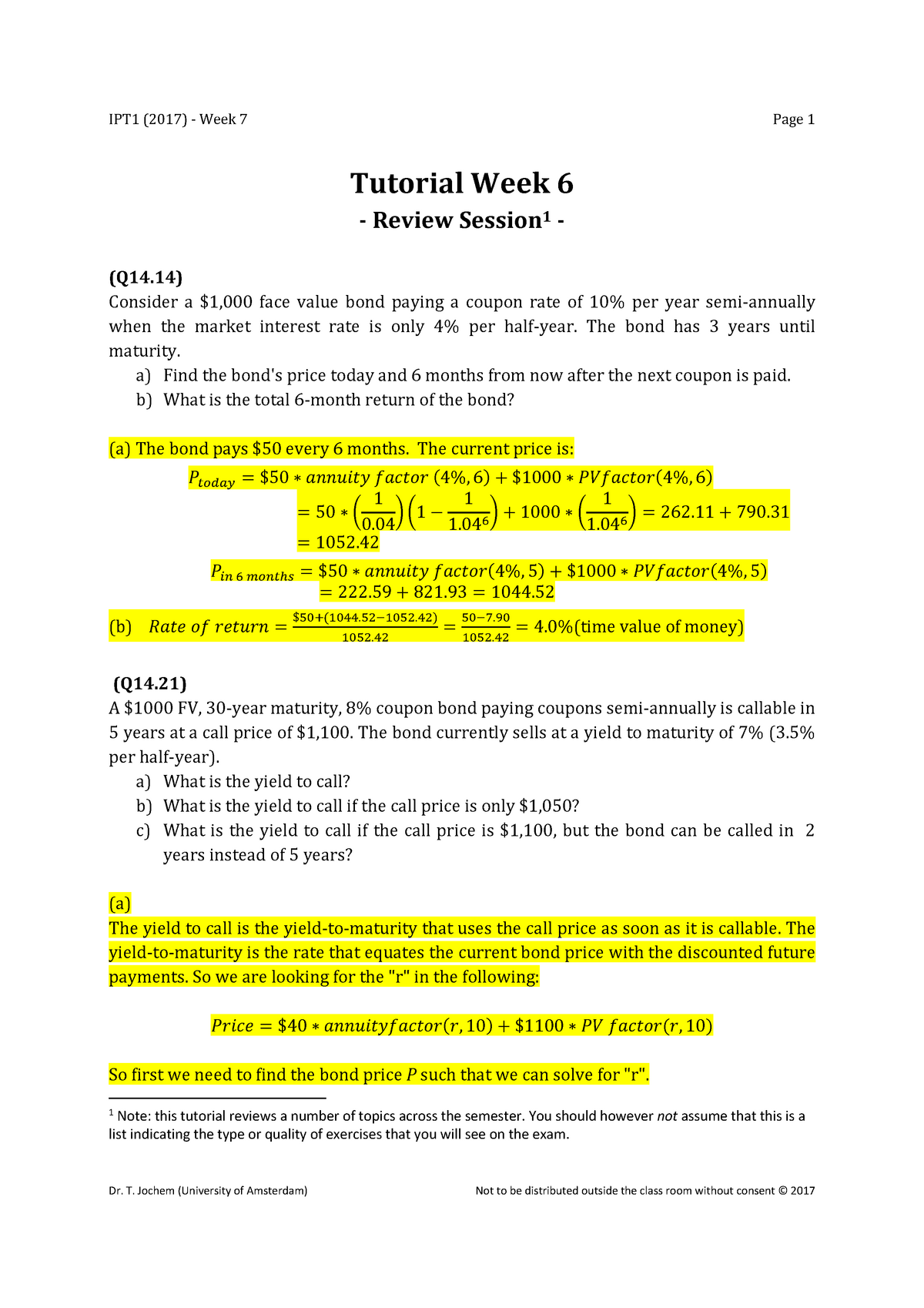

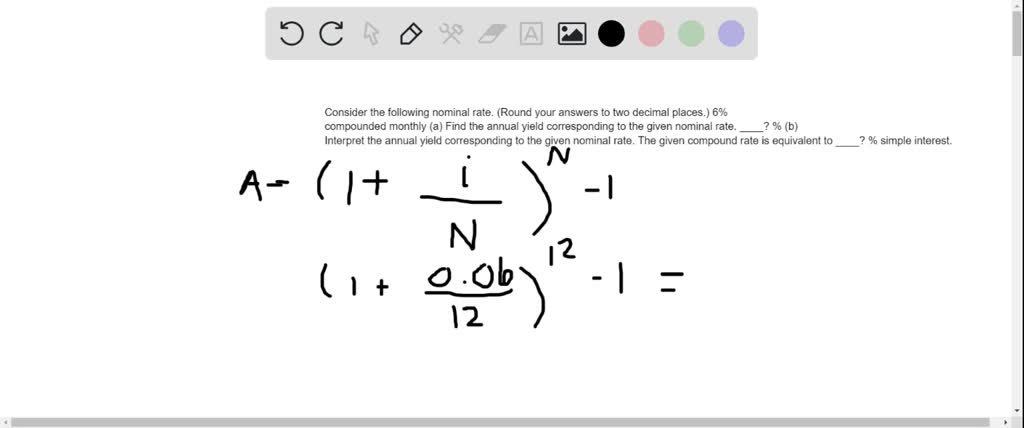

42 consider a bond paying a coupon rate of 10 per year semiannually when the market

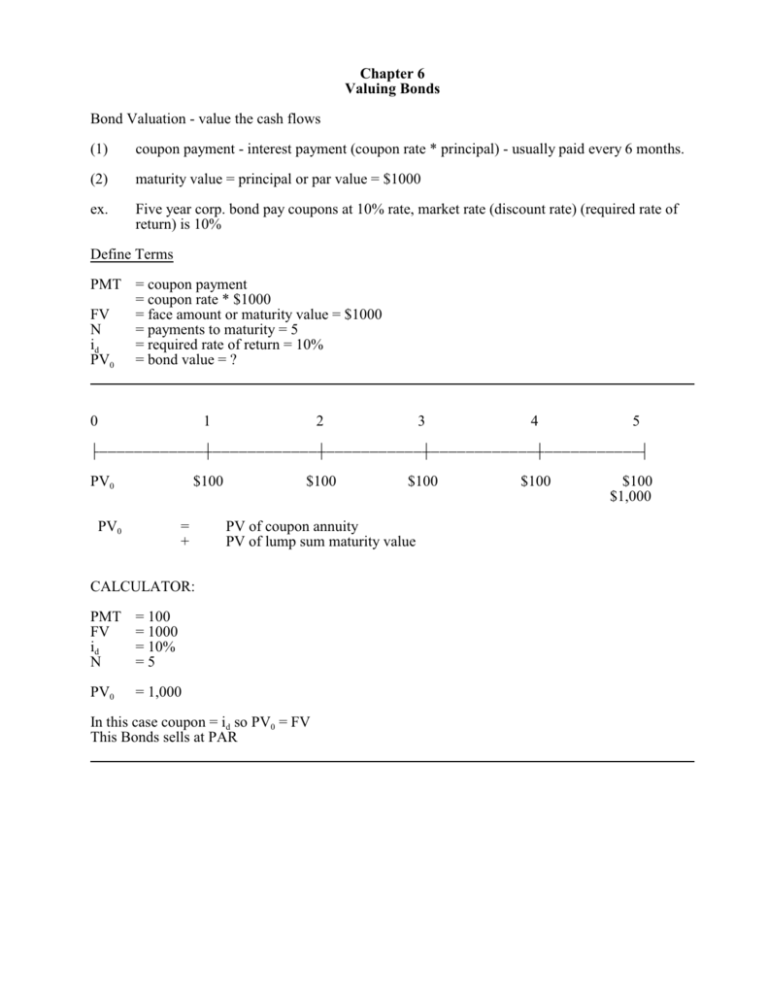

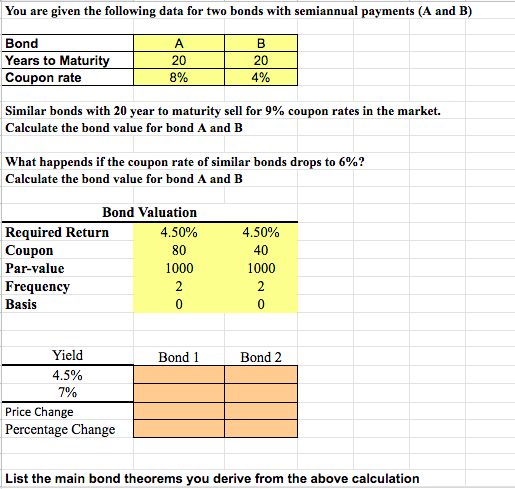

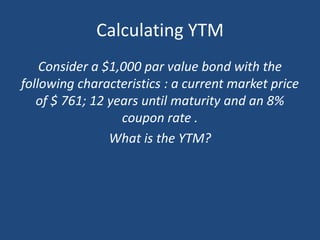

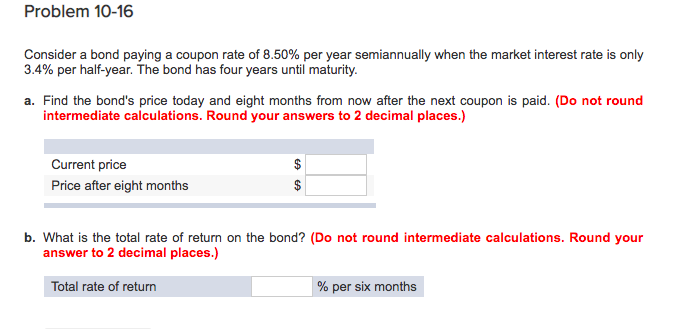

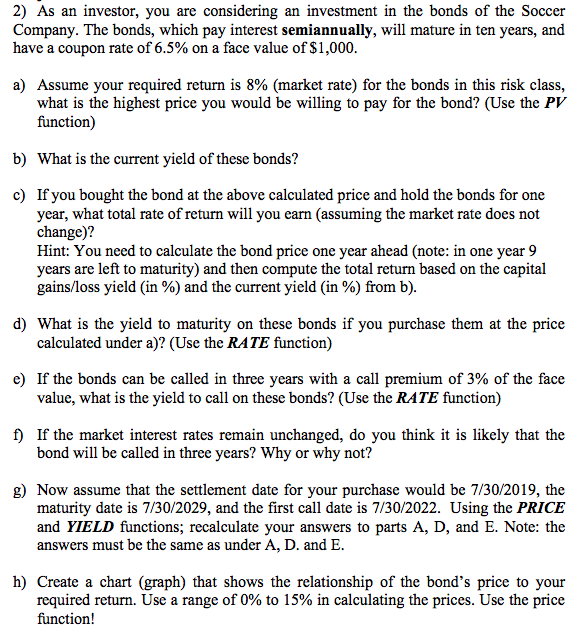

Chapter 10 Quiz - Score: 37/50 Points 74 % 1. Award - StuDocu Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has three years until maturity ... Consider a bond paying a coupon rate of 10% per year ... - Study.com Answer to: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3...

Consider a bond paying a coupon rate of 10% per year ... The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market

ECO526_Review Sheet Questions_百度文库 12) Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until ... Finance Investments Chapter 10 HW - If the last interest payment ... Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until ... Consider a bond paying a coupon rate of 10% per year semiann Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Problem Set 2: Bonds - -- | HEC Paris Consider a coupon bond paying a coupon rate of 7% over 4 years and with a face value of 100. The yield-to-maturity of this bond is equal to 4%. a. What is the ... Solved Consider a bond paying a coupon rate of 10% per - Chegg Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years ... Consider a bond (with par value = $1000) paying a coupon rate of ... Answer to: Consider a bond (with par value = $1000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per... Consider a bond paying a coupon rate of 10% per year semiannually... Consider a bond paying a coupon rate of 10% per year semiannually... · Bond price=face value/(1+r)^n+semiannual coupon*(1-(1+r)^-n/r · Price of the bond after six ...

Consider a bond paying a coupon rate of 10% per year semiann Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until ... Finance Investments Chapter 10 HW - If the last interest payment ... Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until ... ECO526_Review Sheet Questions_百度文库 12) Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until ...

Post a Comment for "42 consider a bond paying a coupon rate of 10 per year semiannually when the market"