› homework-help › questions-andSolved The yield to maturity of one-year zero coupon bond is ... Oct 04, 2022 · The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6%, specify the arbitrage trading strategy. Question: The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6% ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ...

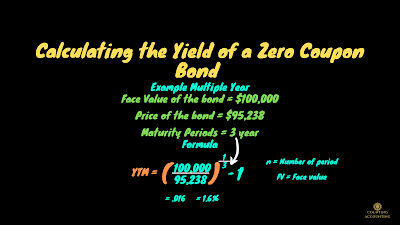

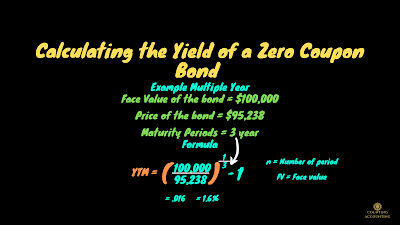

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Yield to maturity of zero coupon bond

Chapter 1

Yield to Maturity (YTM): Formula and Calculator

![Solved] The yield to maturity on 1 year zero coupon bonds is ...](https://www.coursehero.com/qa/attachment/20019199/)

Solved] The yield to maturity on 1 year zero coupon bonds is ...

Zero-coupon yield curve for French government bonds estimated ...

Zero-Coupon Bond Yield To Maturity (YTM)

Zero Coupon Bonds Explained (With Examples) - Fervent ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ...

Finance 30233, Fall 2006

Bond's Maturity, Coupon, and Yield Level | CFA Level 1 ...

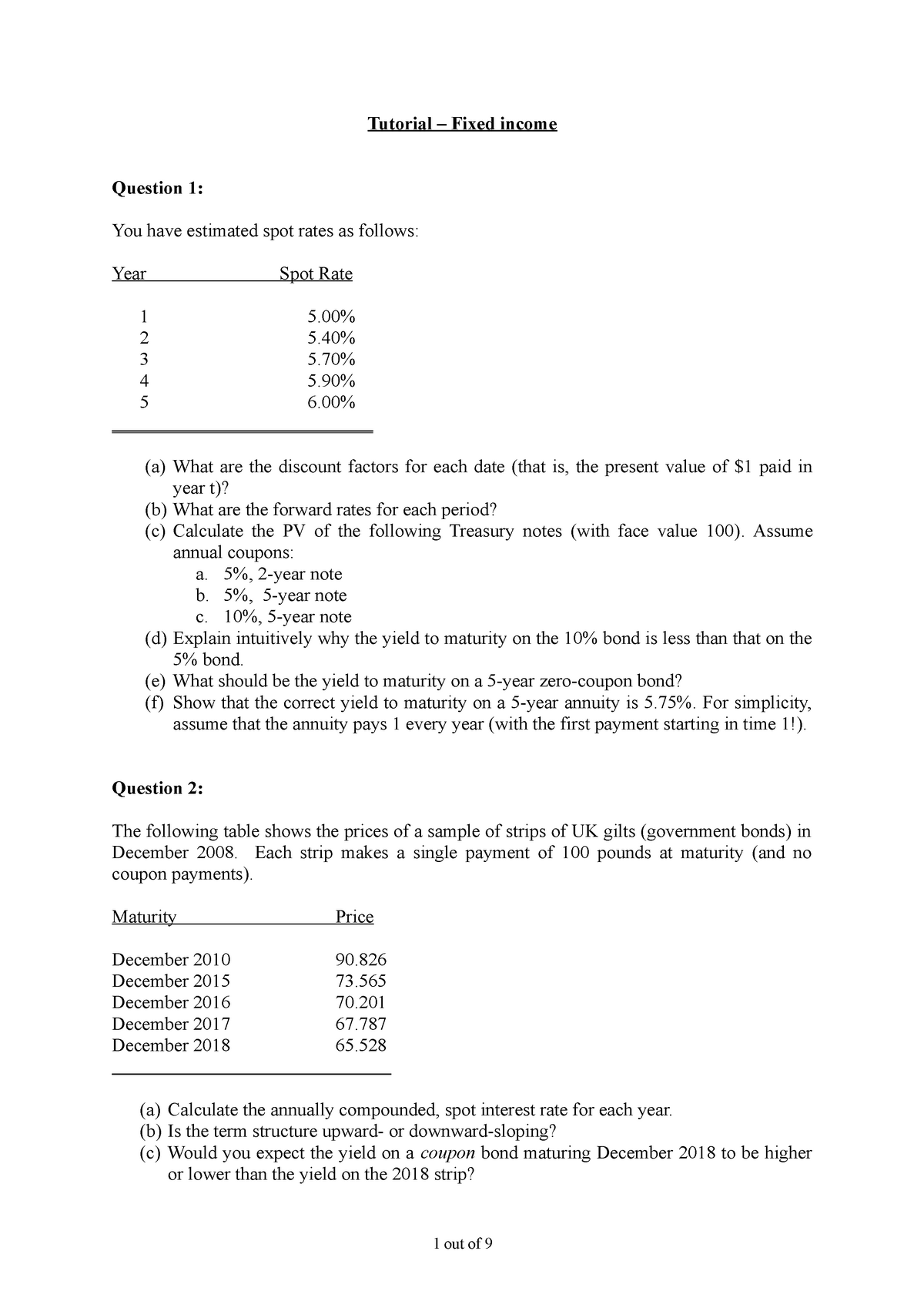

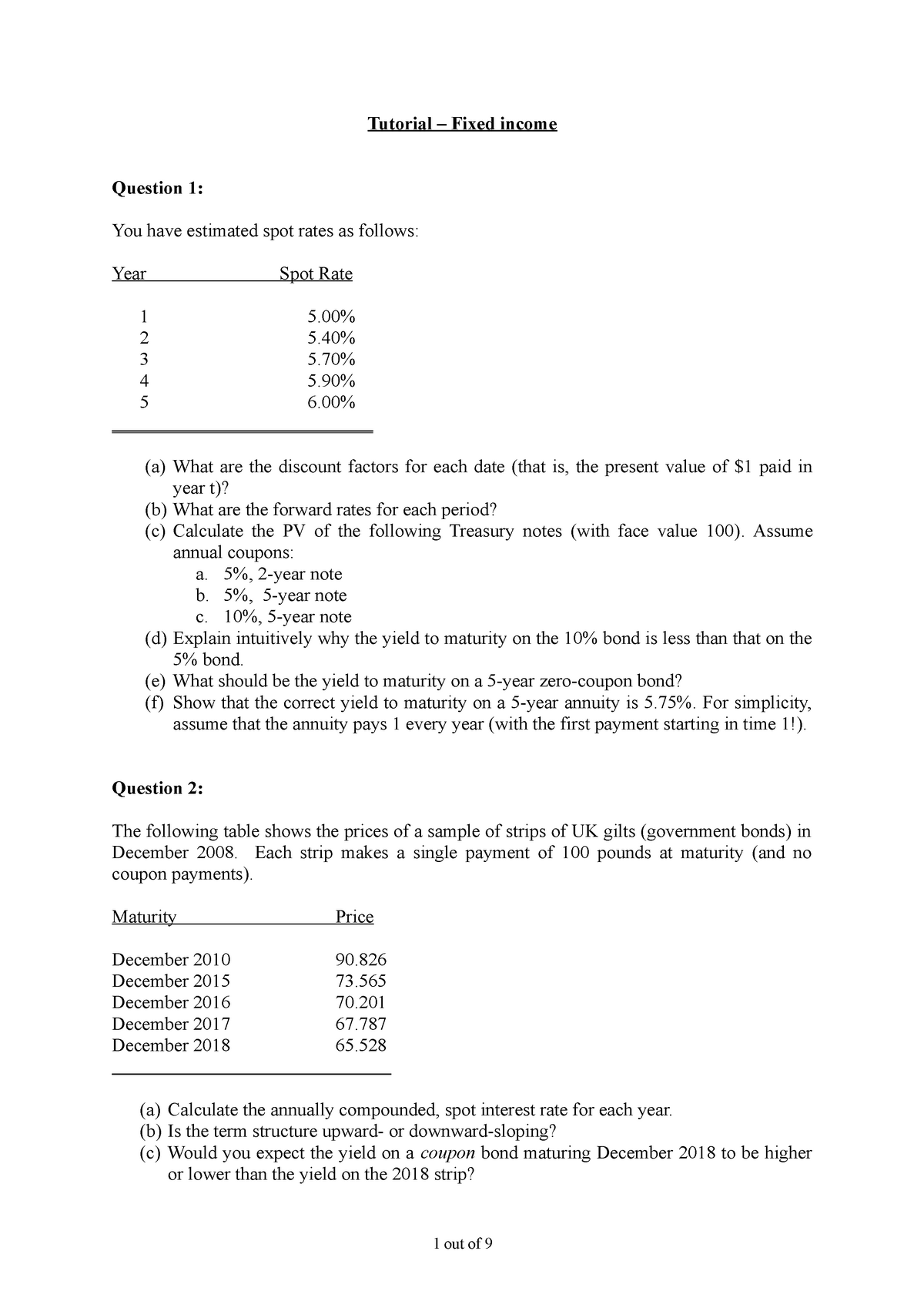

Tutorial - Bonds - solved problems - Tutorial – Fixed income ...

which 10000 bond has the higher yield to maturity a twenty year bond selling for 8000 with a current

Zero-Coupon Bond - an overview | ScienceDirect Topics

Zero Coupon Bond Calculator - Calculator Academy

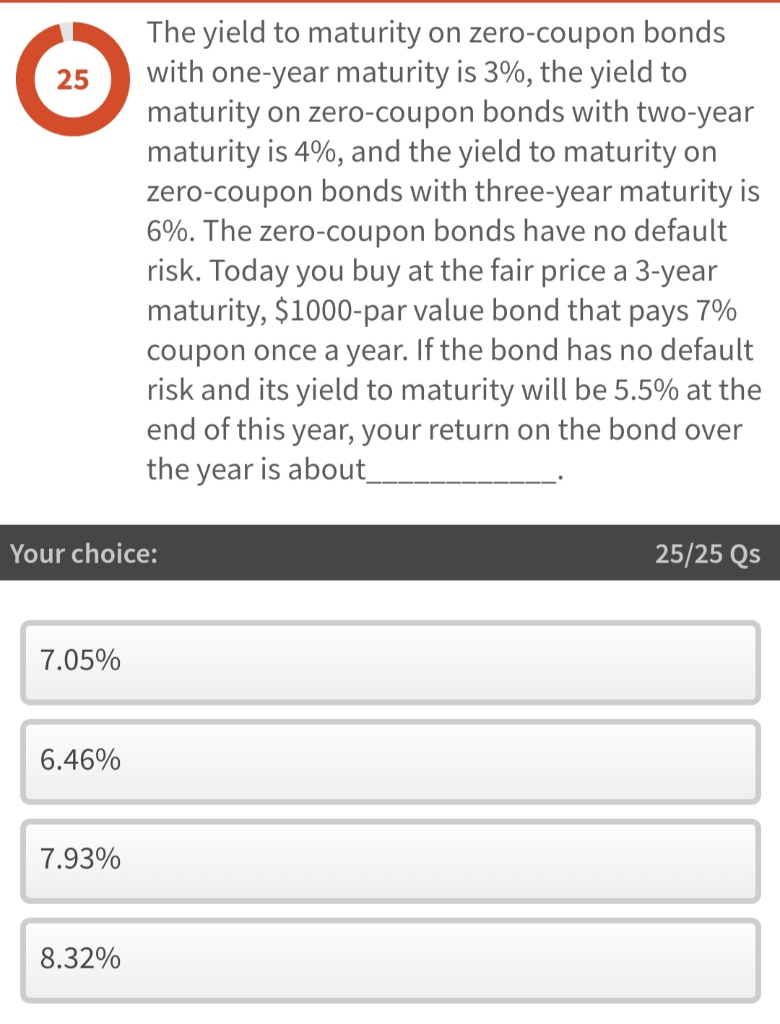

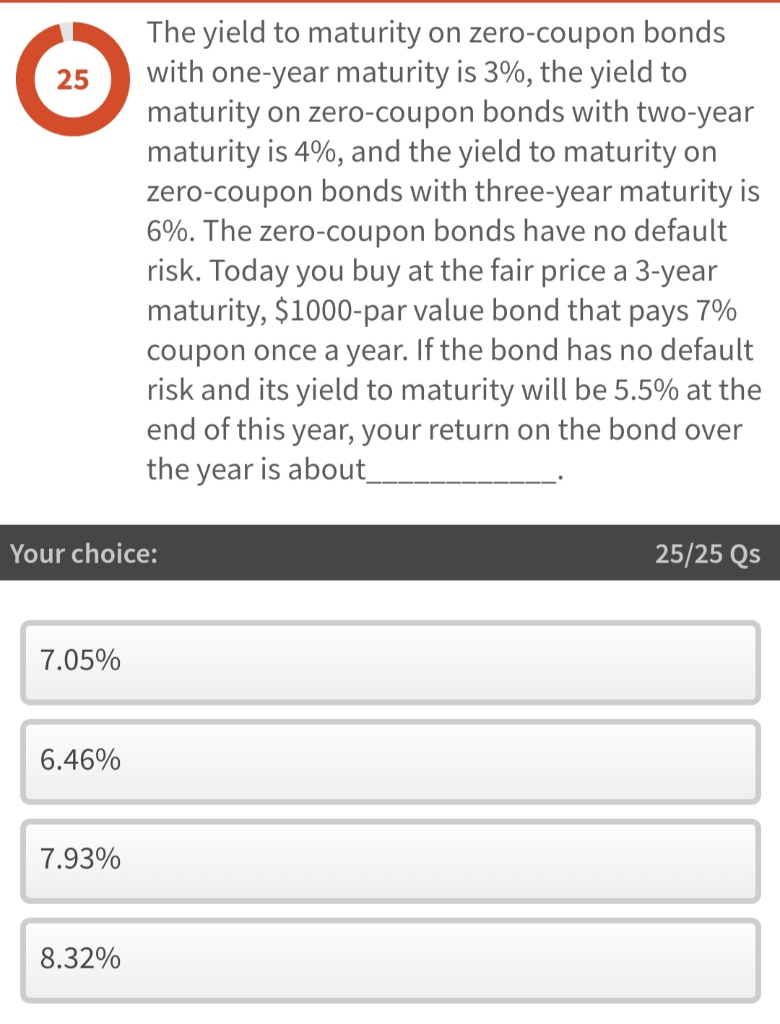

Solved 25 The yield to maturity on zero-coupon bonds with ...

Finding YTM of a Zero Coupon Bond (6.2.1)

Explain conceptually how bonds are priced. Moreover, define ...

Zero-Coupon Bond - an overview | ScienceDirect Topics

Problem Set # 12 Solutions 1. A convertible bond has a par ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks

A newly issued 20-year maturity, zero-coupon bond making ...

Zero Coupon Bond Definition and Example | Investing Answers

Handout on Yield Curves: Adam B. Ashcraft Objects: Maturity ...

Holding Period Return and Yield to Maturity for Zero-Coupon ...

Primer: Par And Zero Coupon Yield Curves | Seeking Alpha

How to Calculate the Yield of a Zero Coupon Bond? | by Tameem ...

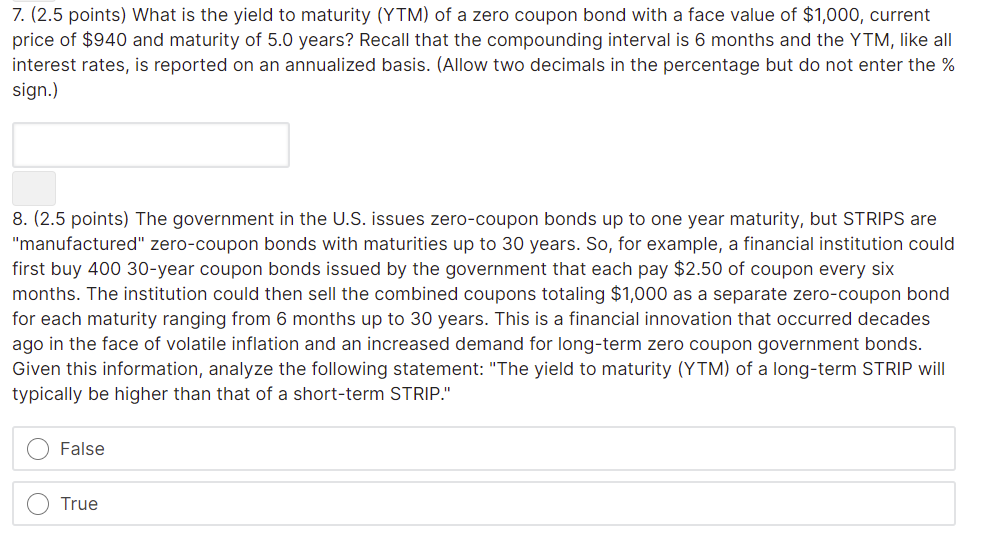

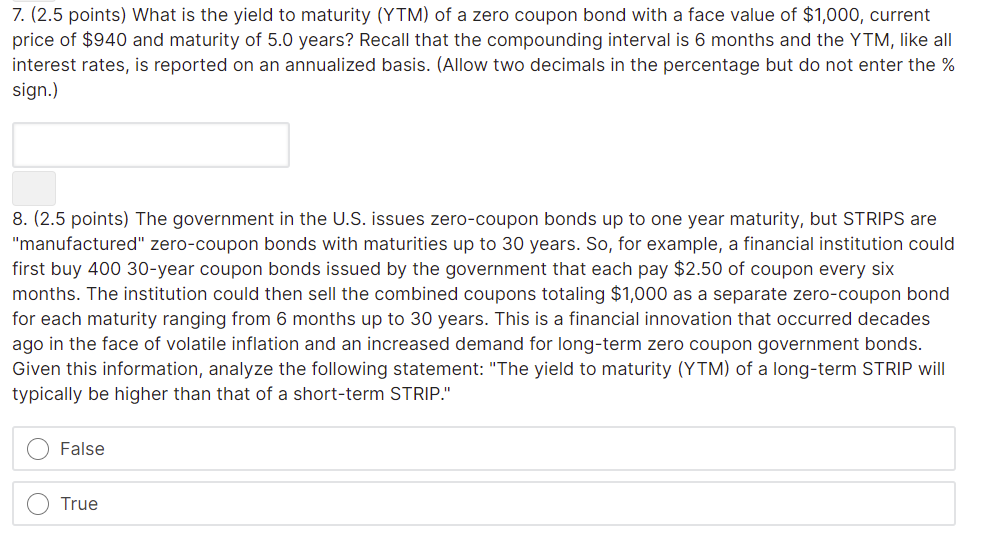

Solved 7. (2.5 points) What is the yield to maturity (YTM ...

The yield to maturity (YTM) on 1-year zero-coupon bonds is 5 ...

Chapter 4 Understanding Interest Rates. Learning Objectives ...

Trading zero-coupon bond with maturity T = 5 years. Average ...

Coupon Bond Formula | Examples with Excel Template

LECTURE 09: MULTI-PERIOD MODEL BONDS

Yield to Maturity – What it is, Use, & Formula – Speck & Company

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

PDF] Zero Coupon Yield Curve Estimation with the Package ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield vs. Yield to Maturity

What is a Zero-Coupon Bond? - Robinhood

Computing Risk Free Rates and Excess Returns Part 1: From ...

Answered: A company issued zero coupon bonds of… | bartleby

Calculating the Yield of a Zero Coupon Bond

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 yield to maturity of zero coupon bond"