41 current yield coupon rate

Difference Between Coupon Rate and Required Return Difference Between Current Yield and Coupon Rate Coupon Rate vs Required Return The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the bond matures, whereas required return is the amount accepted by the investor for assuming the responsibility ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

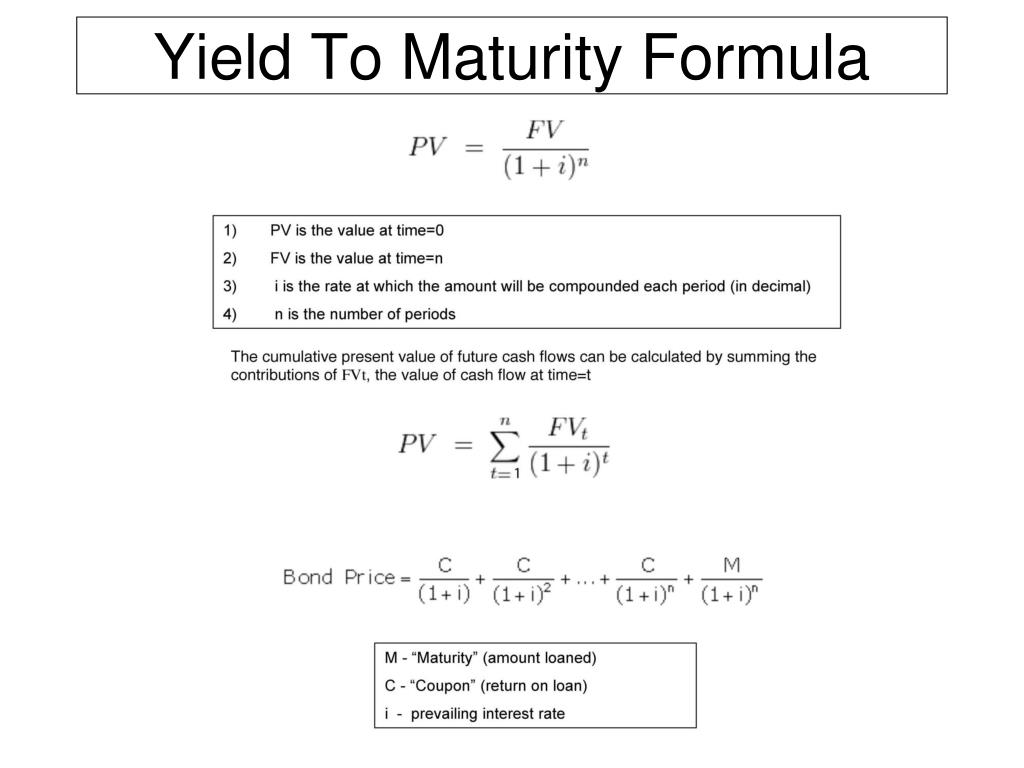

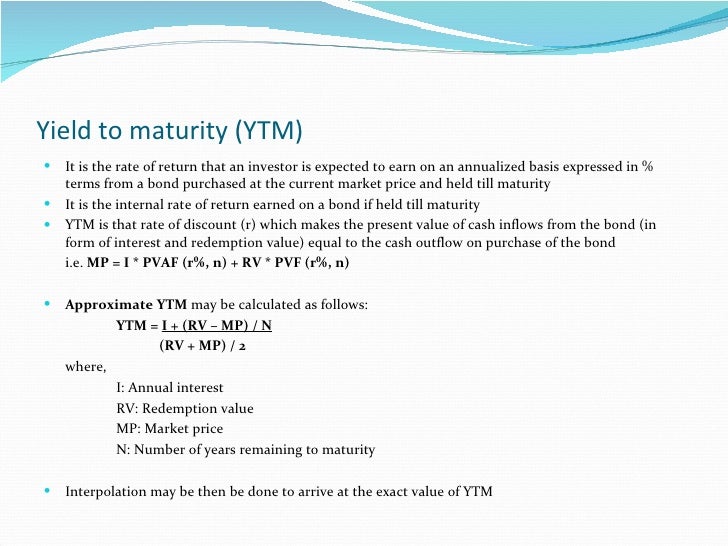

Yield to Maturity | Formula, Examples, Conclusion, Calculator 24/03/2021 · C = future cash flows/coupon payments; r = discount rate (the yield to maturity) F = Face value of the bond; n = number of coupon payments ; Let’s use the figures from above to work out the value of the bond, assuming the coupon payments are made once per year: Here we can see that the current fair valuation of the bond is $7.15 more than the purchase price, …

Current yield coupon rate

Current Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53% Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator 27/06/2021 · Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) Calculator. Algebra Civil Computing Converter Demography Education Finance Food Geometry Health Medical Science Sports Statistics. Formulas; Contact; Search. Coupon Rate Calculator. Home › Finance › Economic Benefits. Posted by Dinesh on … Bonds - MunicipalBonds.com California Yield Curve. Maturity Year Number of Trades Average Yield Dollar Volume; 2022: 71: 1.481: $13,265,000+ 2023 ... Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from State Income Taxes; ... The MSRB accepts no responsibility for the accuracy of the reproduction of the Service or that Service is current.

Current yield coupon rate. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.084% yield.. 10 Years vs 2 Years bond spread is -2.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 19.10 and implied probability of ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ... What Is Current Yield? - The Balance Knowing a bond's coupon yield and current yield can help you anticipate your return on investment. Let's take a look at the math to calculate current yield. Again, if you receive $20 in annual interest on a bond with a par value of $1,000, the coupon rate is 2%. Coupon Rate - Meaning, Calculation and Importance - Scripbox Therefore, the current prevailing price of the bond has no impact on the coupon payments. Furthermore, couponrates have an impact on bond prices. When the interest rates in the market are higher than the bond's couponrate, the bond prices fall. ... Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face value (at a ...

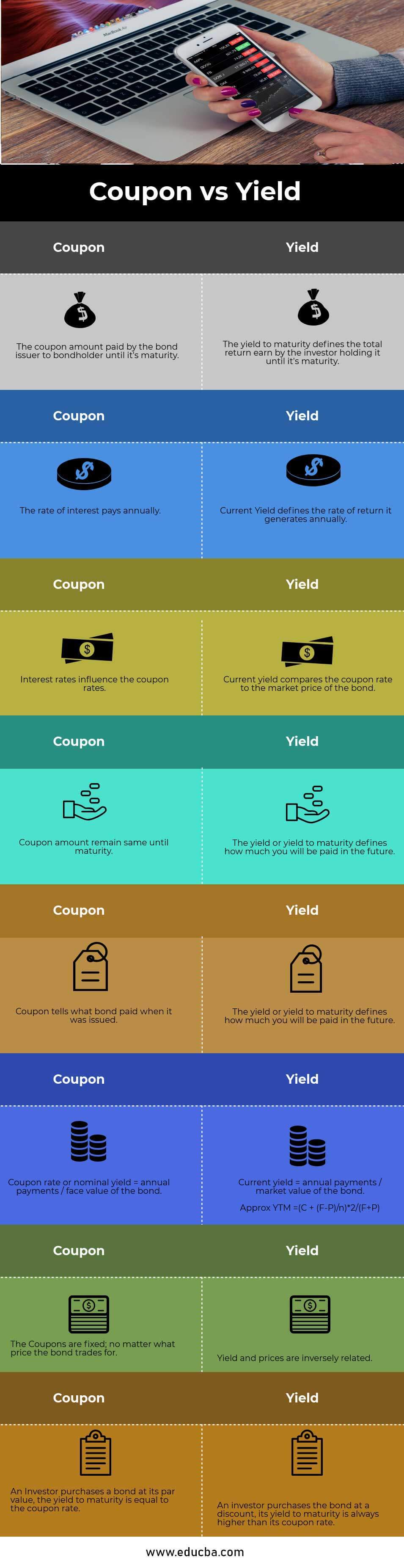

Understanding The Yield Curve - Forbes Advisor You can calculate yield by dividing the coupon interest rate by a bond's current price in the secondary market: Yield = Annual Coupon / Bond Price. A yield curve is plotted on an X/Y axis. The ... How to Calculate Current Yield (Formula and Examples) Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the bond until maturity. ... To calculate the current yield, he can use the following formula: Current yield = annual coupon interest / bond price = $4,000 / $18,200 = 0.2197 The current yield is 21.97% if you multiply 0.2197 by 100 ... Bond Yield: Definition & Calculation with Interest Rates Current Yield = Annual Coupon Payment / Bond's Market Price It is only when a new bond is bought at par and held until its maturity that its coupon rate and its current yield will be the same. 2. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... Yield to maturity - Wikipedia If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity ... and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change. So the bond is priced approximately … US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 10 hours ago, on 7 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities. Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically …

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ...

› yield-to-maturityYield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · The bond has a price of $920 and the face value is $1000. The annual coupons are at a 10% coupon rate ($100) and there are 10 years left until the bond matures. What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia An ABCXYZ Company bond that matures in one year, has a 5% yearly interest rate (coupon), and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change.

Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It …

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Daily Treasury Yield Curve Rates - YCharts Euro Yield Curves: Jul 7 2022, 17:00 EDT: Daily Treasury Yield Curve Rates: Jul 7 2022, 18:00 EDT: Japan Government Bonds Interest Rates: Jul 7 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Jul 7 2022, 19:50 EDT: Euro Short-Term Rate: Jul 8 2022, 02:00 EDT: Spain Interest Rates: Jul 8 2022, 04:00 EDT: European Long Term Interest Rates ...

Current Coupon Definition - Investopedia Current Coupon: The to-be-announced (TBA) mortgage security of any issue for the current delivery month that is trading closest to, but not exceeding par value. TBA mortgage securities with the ...

Determine Coupon Rate, Current Yield, and Yield to Maturity The Garland Corporation has a $1,000 par value bond outstanding with a $90 annual interest payment, a market price of $820 and a maturity date in five years. Find the following: a. The coupon rate. b. The current yield. c.

Current Yield vs. Yield to Maturity - Investopedia 13/12/2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ...

Coupon rate, current yield - FMSbonds.com The coupon rate reflects the amount of interest paid annually based on the face amount of the bond (par value). The current yield is computed by dividing the dollar price into the coupon. Example: A 5% coupon selling at a price of 105.00 has a current yield of 4.76% (5.00 divided by 105 = 4.76).

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "41 current yield coupon rate"